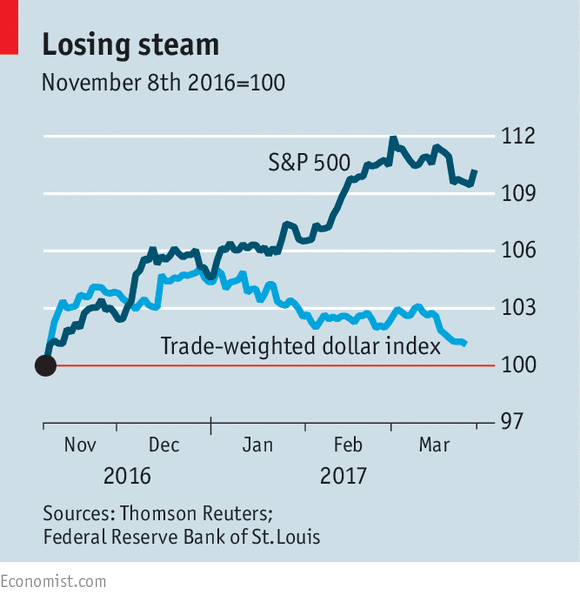

HONEYMOONS don’t last for ever. Having been a reluctant bride to President Donald Trump when courted in the run-up to November’s election, the American stockmarket quickly melted into a mood of romantic euphoria. Shares rose by 12% between election day and March 1st (see chart). But in recent days, sentiment has dimmed. There is talk of the “Trump-disappointment trade”.

For the markets to experience some kind of sell-off is hardly a surprise. The S&P 500 index had gone more than 100 days without a 1% decline, the longest such streak since 1995. And the setback should not be exaggerated. The S&P 500 remains well above its pre-election level, compared with the dollar, which has given up around half its gains. The ten-year Treasury-bond yield, which hit 2.62% on March 13th, has dropped back to 2.38%.

The immediate cause of the retreat seemed to be the failure of Mr Trump to repeal his predecessor’s health-care bill. That logic was hardly a great advertisement for capitalism, implying that the fewer Americans had access to health insurance, the happier investors would be. But the broader rationale seemed to be that, if the Republicans…